Property taxes are collected by local governments to pay for community services, such as schools, roads, and emergency response.

But local officials aren’t the only ones with a role in the process. In fact, the most important person is you, the taxpayer.

Texas REALTORS® is continuing a public campaign to educate Texas taxpayers about the enhanced transparency and engagement opportunities now in place thanks to the passage of property tax reform legislation in 2019.

Use the materials below to learn how you can engage in the process that determines your property tax bill.

How Texas Property Taxes are Changing

A new law known as The Texas Property Tax Reform and Transparency Act of 2019 made several changes to the property tax system.

Check out the video series below for an explanation of the many changes resulting from this pro-consumer legislation.

Download “What’s Changed After Senate Bill 2?” PDF for an in-depth explanation of the changes.

Share these infographics

The Annual Property Tax Process

Every year, the property tax process follows a series of steps:

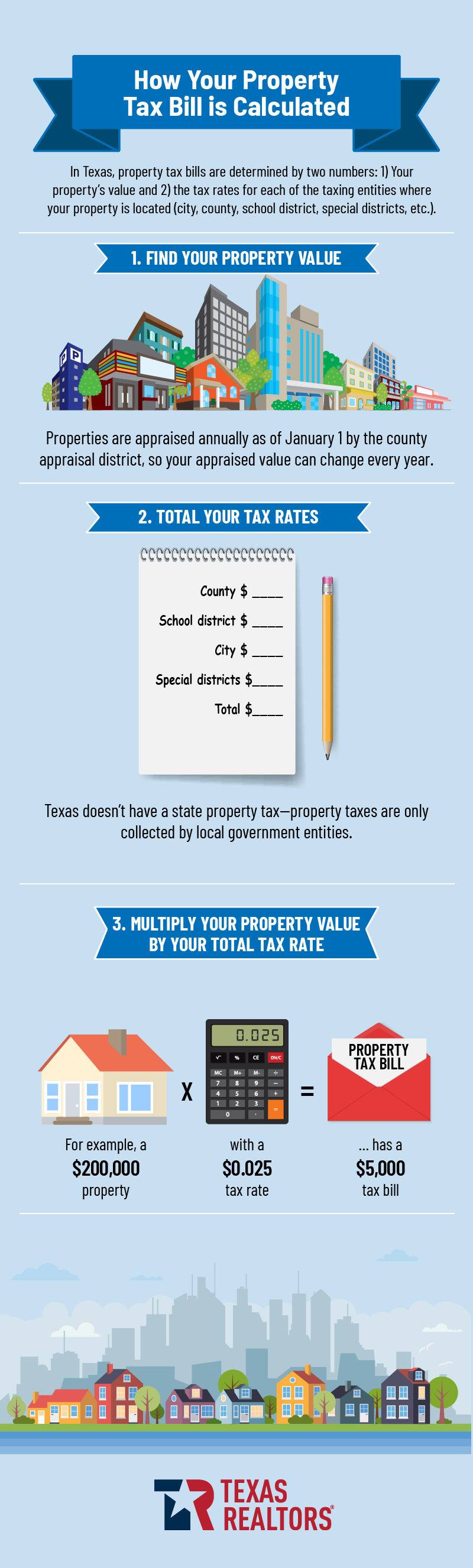

How your property tax bill is calculated

See the numbers that factor into your annual property tax bill.

How Property Tax Exemptions Save You Money

Texas homeowners may qualify for one or more exemptions that can lower their property tax bill.